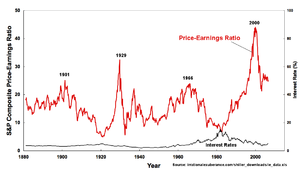

| Plot of S&P Composite Real Price-Earnings Ratio and Interest Rates using data from irrationalexuberance.com/shiller_downloads/ie_data.xls (Photo credit: Wikipedia) |

Friday, June 22, 2012

Money Management in a Down Economy

Friday, March 23, 2012

What will it take to become a Millionaire?

Do

you want to be successful or flourishing, especially in financial respects? The

majority of people would probably answer yes to this question, particularly because

of the current economic conditions. According to dictionary.com, being

successful in financial respects is known as prosperity. Although we would all

like to prosper, it isn’t an easy task. This blog may be called prosperity

formula, but sadly there is not a formula that leads you to prosperity. People

or businesses that reach prosperity tend to do it in their own way. Some

individuals and business leaders have always been great with their money and investments

and have prospered on their own; others have needed assistance and guidance. Financial

planners can be very helpful in creating a strategy for money management.

Certain banks and credit unions such as Lake

Trust Credit Union can also assist you in your effort or your businesses to

prosper. Their website offers calculators such as savings

calculators, budget calculators

and more to help you manage your financial life. Offline, Lake Trust

representatives, may be helpful to you as well. Check out their office locations

to find a representative near you to create a financial plan so you can be on

your way to becoming a millionaire!

Subscribe to:

Posts (Atom)